Multifamily Market Shifts: Bnpl And What Florida Property Owners Should Know

Multifamily Market Shifts: Why BNPL Rent Payments Signal a Bigger Issue for Florida Property

The multifamily real estate market is shifting in noticeable ways across Florida, including areas like Pensacola, Panama City, Tallahassee, Jacksonville, and nearby Alabama markets such as Mobile. One emerging trend drawing attention is the use of Buy Now, Pay Later (BNPL)–style rent payment programs within multifamily housing.

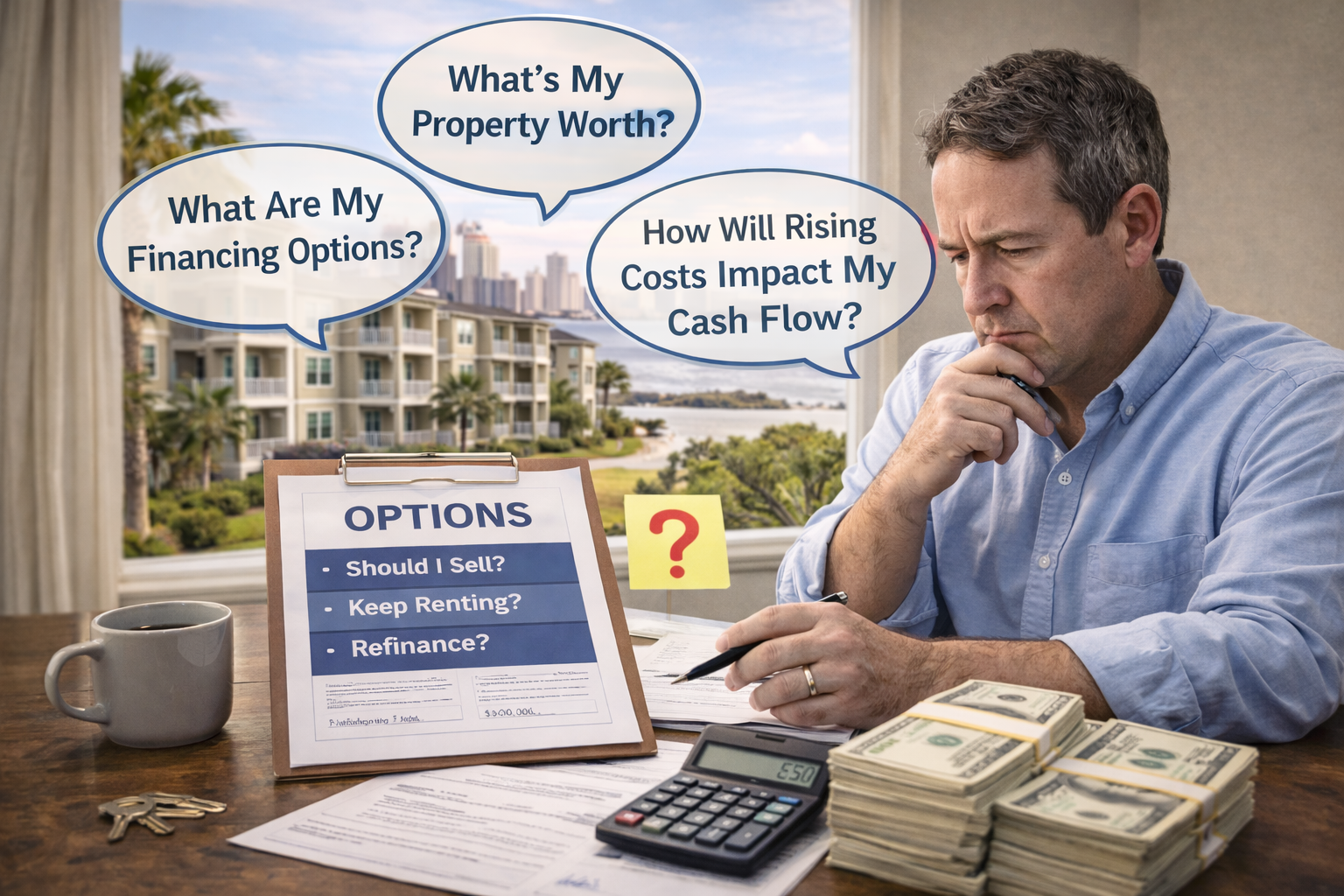

While BNPL is often discussed as a flexible solution for renters, its growing presence in the multifamily space tells a deeper story about cash flow pressure, rising operating costs, and changing owner decisions. For many small and mid-sized multifamily property owners, this shift is becoming a signal — not a solution.

What Is BNPL and Why Is It Showing Up in Multifamily Housing?

BNPL, or Buy Now, Pay Later, allows payments to be split or deferred over time. In multifamily housing, this often appears as rent-flex or split-payment programs offered through third-party platforms. The property typically receives rent upfront, while the tenant repays the service provider over installments. Buy now, pay later programs have grown rapidly in recent years, prompting increased attention from consumer finance regulators.

On the surface, this may appear to stabilize rent collection. In reality, it reflects a growing gap between what renters can comfortably afford and what properties require to operate consistently.

Buy now, pay later BNPL is a type of short-term financing that lets consumers split the cost of purchases into smaller payments

Why Multifamily Owners in Florida Are Feeling More Pressure

Across Florida’s Gulf Coast and inland metro areas, multifamily owners are facing overlapping challenges:

- Rising insurance premiums, especially in coastal counties

- Higher maintenance and repair costs in aging buildings

- Slower rent growth compared to prior years

- Increased vacancy or longer turnover periods

- Stricter lending and refinancing conditions

In markets like Pensacola and Panama City, many small apartment buildings were built decades ago and now require ongoing capital investment. When rent payments become fragmented or delayed — even with BNPL tools — the strain shifts directly to ownership.

BNPL Solves Short-Term Rent Gaps, Not Long-Term Property Risk

BNPL-style rent programs can temporarily smooth collections, but they do not change the underlying math of property ownership.

CFPB interpretive rules clarify how BNPL lenders are treated under federal credit law, reinforcing that these tools are credit products rather than simple payment conveniences.

Mortgages, insurance, taxes, and utilities remain due in full and on time. Deferred rent does not reduce operating costs, and inconsistent payment structures can complicate forecasting, refinancing, and exit timing.

How These Multifamily Shifts Also Affect Single-Family Rental Owners

While BNPL is most visible in multifamily housing, similar pressures are affecting single-family rental owners across Florida. Rising insurance costs, maintenance expenses, and slower rent growth are leading many small landlords to reassess whether holding a rental property still aligns with their goals.

When Multifamily Owners Begin Exploring a Cash Exit

As financial unpredictability increases, many owners start reassessing their options. This is especially common with:

- Small multifamily properties (2–20 units)

- Owner-managed buildings

- Properties with older roofs, plumbing, or electrical systems

- Assets affected by insurance hikes or deferred maintenance

In Florida and nearby Alabama markets, owners in these situations often look for a way to simplify their position rather than restructure payments indefinitely.

Selling a Multifamily Property for Cash in Florida

A cash sale offers a straightforward alternative for owners facing ongoing uncertainty. For multifamily properties, this can mean:

- Selling as-is, without making repairs

- Keeping tenants in place

- Avoiding prolonged marketing periods

- Choosing a closing timeline that fits the owner’s situation

At French Investments, we work with property owners across Pensacola, Panama City, Tallahassee, Jacksonville, and surrounding areas who are evaluating whether holding still makes sense. Many of these conversations begin after owners notice changes in rent behavior, operating costs, or lending conditions.

You can learn more about local cash sale options here: https://iwillgetitdone.com/we-buy-houses-in-pensacola-florida/

Common Questions Multifamily Owners Ask

Does using BNPL for rent affect property value? Indirectly, yes. While BNPL may keep collections current short-term, lenders and buyers often focus on consistent, traditional income patterns when evaluating value.

Can I sell a multifamily property with tenants still living there? Yes. Many cash buyers purchase multifamily properties with tenants in place, depending on the situation.

What if rent payments have been inconsistent? Inconsistent rent is more common than many owners realize. Cash buyers typically evaluate the property as a whole, not just recent payment history.

Are small apartment buildings still selling in today’s market? Yes. Smaller multifamily properties continue to change hands, especially when priced for cash transactions and sold as-is.

Final Thoughts on BNPL and Multifamily Market Shifts

The rise of BNPL-style rent payments isn’t just a tenant trend — it’s a market signal. For multifamily owners across Florida, it reflects broader affordability pressures and operational strain. While flexible payment tools may offer short-term relief, many owners ultimately decide that liquidity and simplicity matter more than extending an uncertain holding period.

Understanding these shifts allows owners to make informed decisions about whether to adapt, hold, or explore a cash sale that aligns with today’s market realities.